As one of the largest oil and gas companies in the United States, Occidental Petroleum Corp is a major player in the energy industry. With a rich history dating back to 1919, OXY has consistently demonstrated its ability to adapt and thrive in an ever-changing market. In this article, we'll take a closer look at the company's current stock price, quote, and news, as well as explore what makes OXY an attractive investment opportunity.

A Brief History of Occidental Petroleum Corp

Founded in 1919, Occidental Petroleum Corp has come a long way since its humble beginnings as a small oil producer in California. Over the years, the company has expanded its operations to become one of the largest oil and gas companies in the United States, with a diverse portfolio of assets across North America, Latin America, and the Middle East.

Today, OXY is a global energy giant, with a proven track record of delivering value to shareholders through its diversified business segments. From conventional oil and gas production to unconventional shale plays, OXY's operations span multiple basins and countries, making it an attractive investment opportunity for those looking to diversify their portfolios.

Current Stock Price and Quote

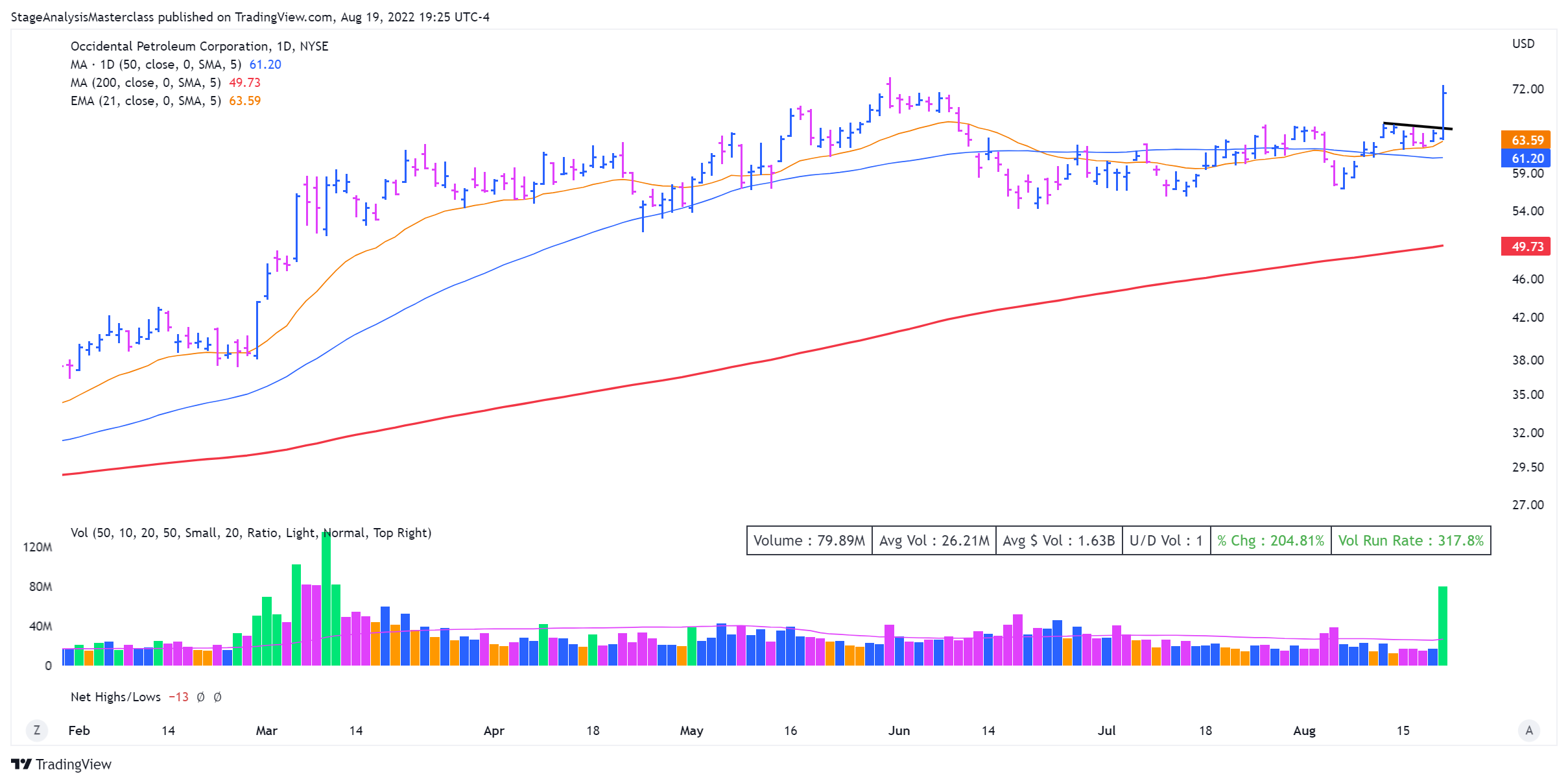

As of [current date], Occidental Petroleum Corp's stock price is $[stock price]. The company's stock has historically been volatile, driven by changes in the global oil market, economic conditions, and regulatory developments. However, with a strong balance sheet and a proven track record of generating cash flows, OXY remains an attractive investment opportunity for those looking to diversify their portfolios.

Here are some key statistics to consider:

Market capitalization: $[market capitalization]

52-week range: $[low] - $[high]

Earnings per share (EPS): $[EPS]

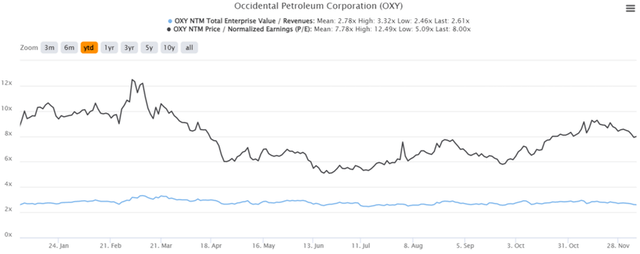

Price-to-earnings ratio (P/E): [P/E]

Recent News and Developments

As one of the largest oil and gas companies in the United States, Occidental Petroleum Corp is constantly making headlines. Here are some recent news stories that may impact the company's stock price:

OXY announces plans to increase production in the Permian Basin, a key shale play in West Texas.

The company reports strong quarterly earnings, driven by increased oil and gas prices.

OXY is acquired by a major integrated energy company, expanding its global reach.

Why Invest in Occidental Petroleum Corp?

There are several reasons why investors may want to consider investing in Occidental Petroleum Corp. Here are a few key points to keep in mind:

Diversified operations: With assets across multiple basins and countries, OXY is less reliant on any one area or market.

Strong balance sheet: The company has a proven track record of generating cash flows and maintaining a strong balance sheet.

Growth potential: As the global energy landscape continues to evolve, OXY is well-positioned to capitalize on new opportunities and grow its business.

In conclusion, Occidental Petroleum Corp is a major player in the energy industry with a rich history, diversified operations, and strong financial performance. While there are always risks associated with investing in any company, OXY's recent track record and growth potential make it an attractive investment opportunity for those looking to diversify their portfolios.