Table of Contents

- Inflation (2020-2023) | Nation

- Inflation, Trump, and More: What’s Ahead for the Economy in 2025

- Inflation set to remain high into 2025, IMF warns - Central Banking

- Inflasi Desember 2023 Terendah 20 Tahun Terakhir, Bagaimana dengan ...

- Inflasi Indonesia punya potensi turun ke 3 persen pada akhir 2023 ...

- Inflation Rate 2025 Predictions Usa - Megan Butler

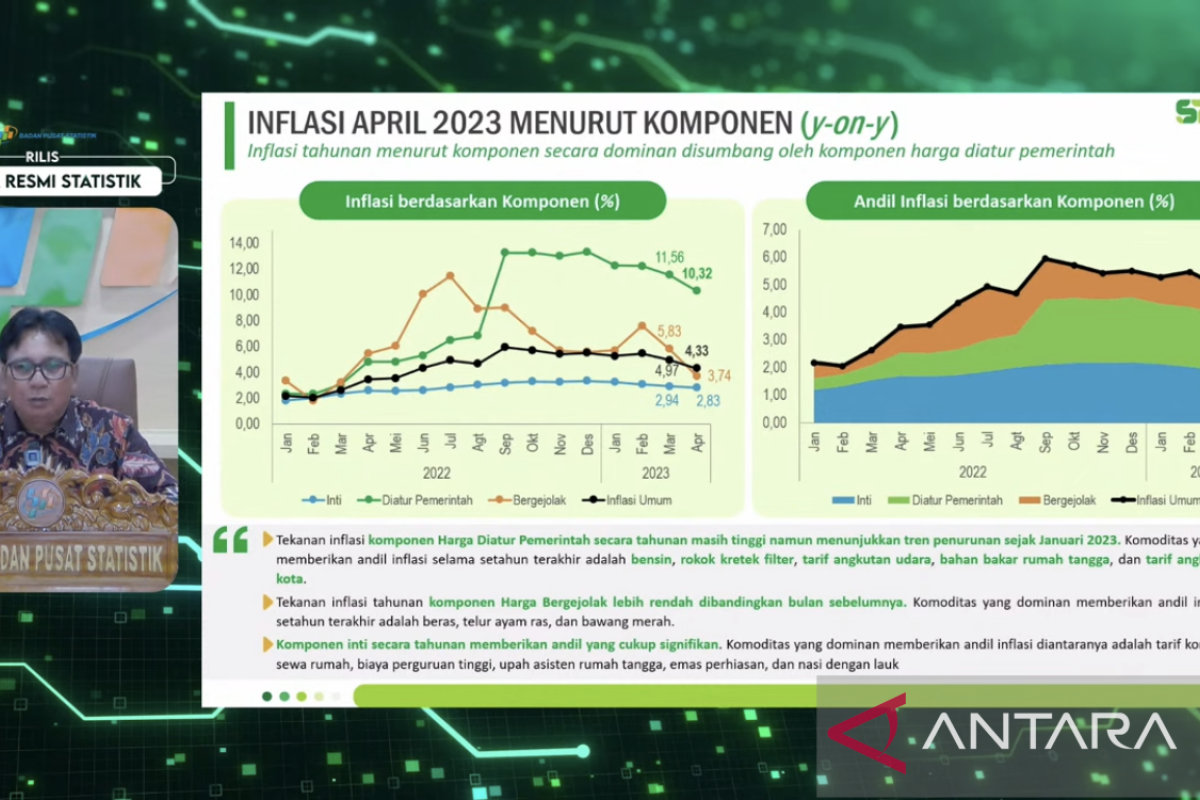

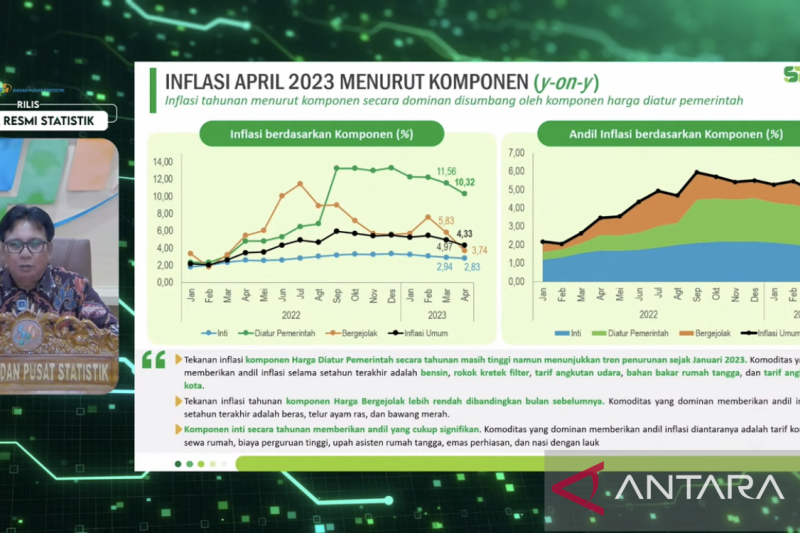

- Menjaga inflasi tahun 2023 - Infografik ANTARA News

- Inflasi Indonesia 2023 Terkendali, Kembali pada Rentang Sasaran dan ...

- Ekonom: Inflasi RI punya potensi turun ke 3 persen pada akhir 2023 ...

- A 2025 GOP takeover wouldn't fully doom Inflation Reduction Act

Historical Overview (1957-2025)

Factors Influencing Core Inflation

Implications and Future Outlook

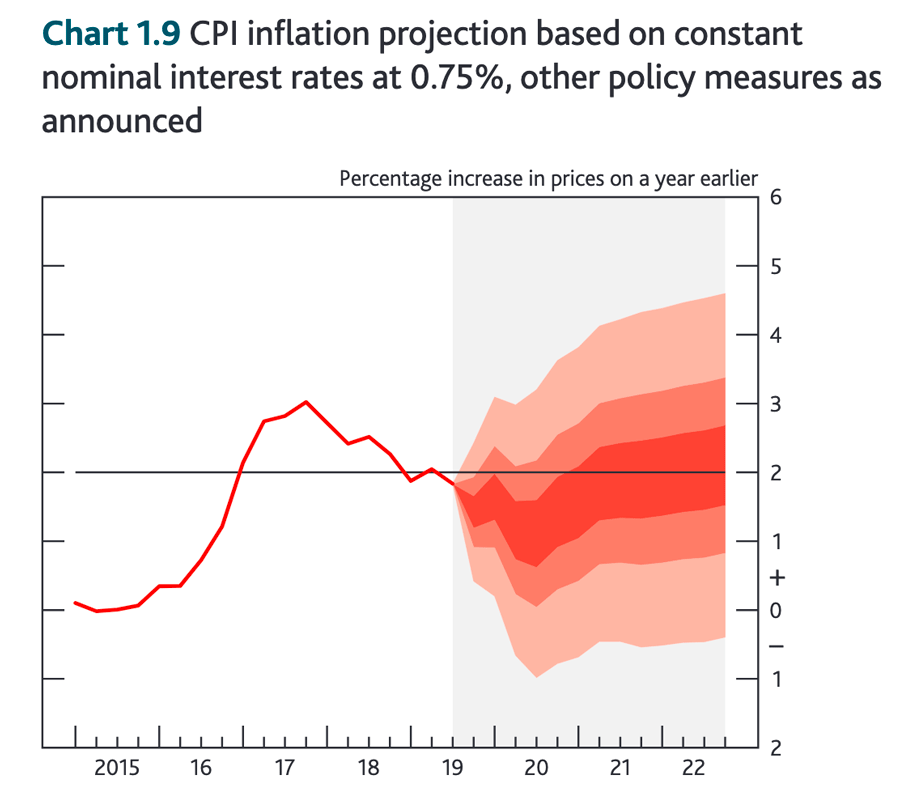

The United States core inflation rate has significant implications for the economy, policymakers, and individuals. A sustained high inflation environment can erode purchasing power, reduce consumer spending, and increase borrowing costs. On the other hand, low inflation can lead to deflationary pressures, reducing economic growth. As we look ahead to 2025, it is essential to monitor the core inflation rate closely. The Federal Reserve's actions, labor market trends, and global events will continue to shape the inflation landscape. Investors and individuals should be prepared for potential changes in interest rates, currency fluctuations, and shifts in asset prices. The United States core inflation rate has undergone significant changes over the past six decades, influenced by various economic, social, and geopolitical factors. Understanding these trends and drivers is crucial for making informed decisions about investments, monetary policy, and economic growth. As we navigate the complexities of the global economy, staying up-to-date with the latest core inflation rate data and analysis will be essential for individuals, businesses, and policymakers alike.Stay ahead of the curve and monitor the latest economic trends with our expert analysis and insights.

Note: The data and projections used in this article are based on historical trends and available forecasts. However, please note that inflation rates can be subject to significant fluctuations and uncertainties, and actual outcomes may differ from projections.