As the new year approaches, taxpayers are eagerly awaiting the 2026 tax bracket changes. The Internal Revenue Service (IRS) has announced the new tax brackets, and it's essential to understand how these changes may impact your finances. In this article, we'll delve into the details of the 2026 tax bracket changes, what they mean for you, and how you can prepare for the upcoming tax season.

What are Tax Brackets?

Tax brackets are the ranges of income that are subject to different tax rates. The US tax system is progressive, meaning that higher income earners are taxed at a higher rate. The tax brackets are adjusted annually to account for inflation, ensuring that taxpayers are not pushed into higher tax brackets due to rising costs of living.

2026 Tax Bracket Changes

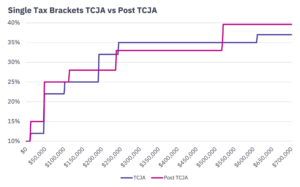

The IRS has announced the new tax brackets for 2026, which will take effect on January 1, 2026. The changes are as follows:

The standard deduction will increase to $13,850 for single filers and $27,700 for joint filers.

The top tax rate of 37% will apply to single filers with incomes above $609,350 and joint filers with incomes above $731,200.

The other tax brackets will be adjusted as follows:

+ 10%: $0 - $11,600 (single), $0 - $23,200 (joint)

+ 12%: $11,601 - $47,150 (single), $23,201 - $94,300 (joint)

+ 22%: $47,151 - $100,525 (single), $94,301 - $190,750 (joint)

+ 24%: $100,526 - $191,950 (single), $190,751 - $364,200 (joint)

+ 32%: $191,951 - $243,725 (single), $364,201 - $462,500 (joint)

+ 35%: $243,726 - $609,350 (single), $462,501 - $731,200 (joint)

How Will the 2026 Tax Bracket Changes Affect You?

The 2026 tax bracket changes may impact your tax liability, depending on your income level and filing status. If you're a single filer with an income above $609,350 or a joint filer with an income above $731,200, you'll be subject to the top tax rate of 37%. On the other hand, if you're a low-to-moderate income earner, you may benefit from the increased standard deduction.

Preparing for the 2026 Tax Season

To prepare for the 2026 tax season, it's essential to understand how the tax bracket changes may affect your tax liability. Here are some tips to help you get ready:

Review your income and expenses to determine how the new tax brackets may impact your tax liability.

Consider consulting a tax professional to ensure you're taking advantage of all the tax deductions and credits available to you.

Take advantage of tax-advantaged savings vehicles, such as 401(k) or IRA accounts, to reduce your taxable income.

The 2026 tax bracket changes are designed to account for inflation and ensure that taxpayers are not unfairly pushed into higher tax brackets. By understanding the new tax brackets and how they may impact your tax liability, you can prepare for the upcoming tax season and make informed decisions about your finances. Remember to review your income and expenses, consult a tax professional if necessary, and take advantage of tax-advantaged savings vehicles to minimize your tax liability.

Learn more about the 2026 tax bracket changes and how they may affect your finances.