Table of Contents

- Navigating the Future of Social Security: A 2025 Perspective | PaySpace ...

- 2025’s Tax Sunset and DC Plans | PLANADVISER

- Social Security Just Released the 2025 COLA. Here's What It Means for ...

- Updated figure of the maximum Social Security taxable amount in 2025

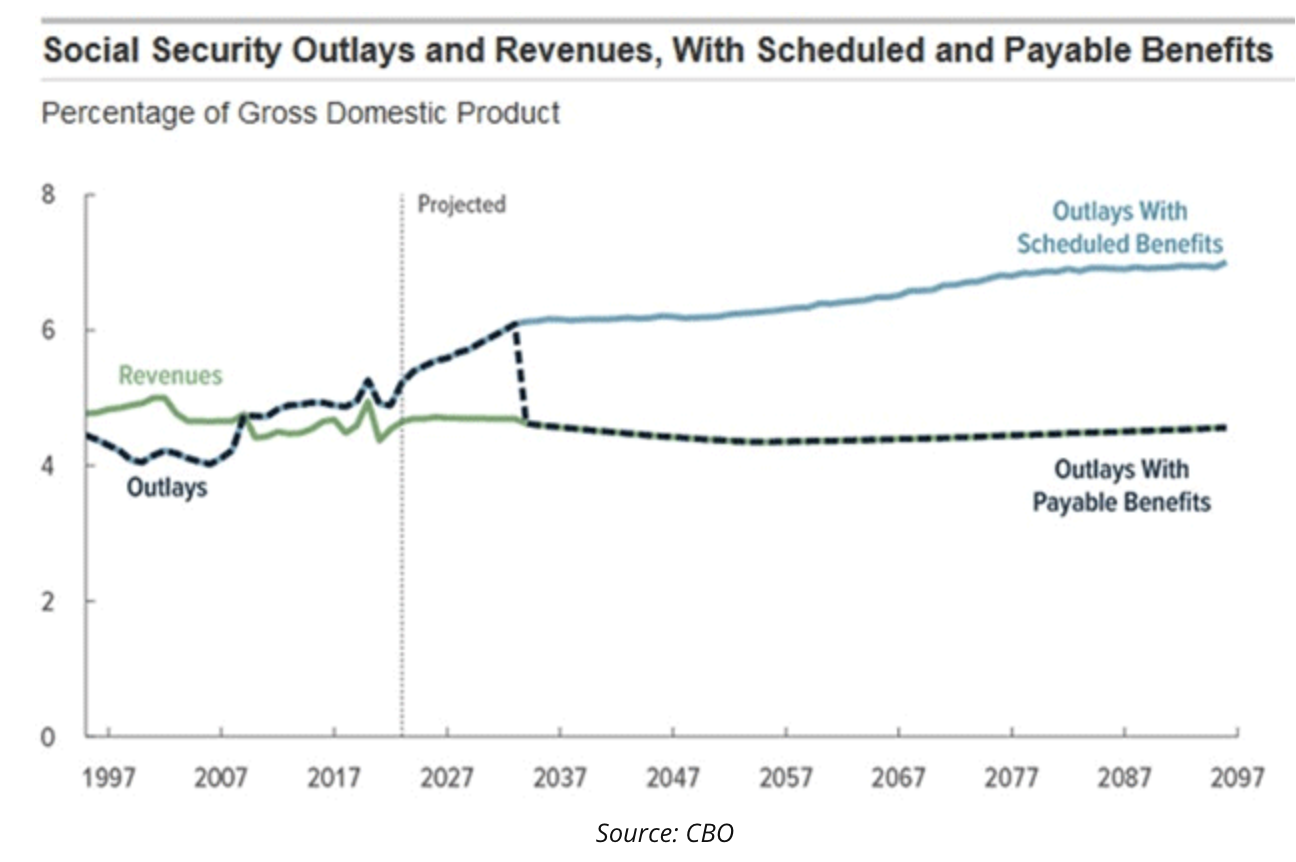

- Social Security Remains Unsustainable

- Planned Social Security Changes for 2025 - Impact on Retirees' Paychecks

- 2025 Social Security COLA Estimate - Latest Update - YouTube

- How Much Ssi Increase In 2025 For Seniors - Janey Lisbeth

- Increase confirmed for different groups of retirees: Here's how Social ...

- Social Security in 2025: What You Need to Know About Benefits and ...

What is the Social Security Wage Base?

How Will the Increased Wage Base Affect You?

Key Takeaways

Here are the key points to remember about the social security wage base for 2025: The social security wage base will increase to $157,000. The change will affect payroll taxes for both employees and employers. Medicare taxes will still be paid on all earnings, regardless of the social security wage base.

Planning Ahead

To prepare for the increased social security wage base, consider the following: Review Your Budget: Employers should review their payroll expenses and budget to account for the increased social security taxes. Update Your Payroll System: Ensure your payroll system is updated to reflect the new social security wage base. Consult a Tax Professional: If you're unsure about how the increased wage base affects you, consult a tax professional or accountant for guidance. In conclusion, the social security wage base increase for 2025 will have implications for employers, employees, and self-employed individuals. Understanding the changes and planning ahead will help you navigate the new wage base and ensure compliance with social security tax regulations. Stay informed and consult with a tax professional if you have any questions or concerns.For more information, visit the Social Security Administration website or consult the Journal of Accountancy for the latest updates on social security and tax regulations.