The COVID-19 pandemic has brought about unprecedented economic challenges, and the US government has been working tirelessly to provide relief to those affected. As part of its efforts, the Internal Revenue Service (IRS) is sending out automatic stimulus payments to eligible individuals and families. But who exactly is getting these payments, and what can they expect?

Who is Eligible for Automatic Stimulus Payments?

The IRS is sending out automatic stimulus payments to individuals and families who meet certain eligibility criteria. These include:

US citizens and resident aliens who have a valid Social Security number

Individuals who have filed a tax return for 2019 or 2020, or have registered for an Economic Impact Payment using the IRS's online tool

Those who have an adjusted gross income (AGI) of up to $75,000 for single filers, $112,500 for head of household filers, and $150,000 for joint filers

Eligible individuals with no income or those who receive federal benefits, such as Social Security, Supplemental Security Income (SSI), or Veterans Affairs benefits

How Much Can You Expect to Receive?

The amount of the automatic stimulus payment varies based on income level and family size. Generally, eligible individuals can expect to receive:

Up to $1,400 for single filers with an AGI of $75,000 or less

Up to $2,800 for joint filers with an AGI of $150,000 or less

Up to $1,400 for head of household filers with an AGI of $112,500 or less

An additional $1,400 for each qualifying child under the age of 17

When Can You Expect to Receive Your Payment?

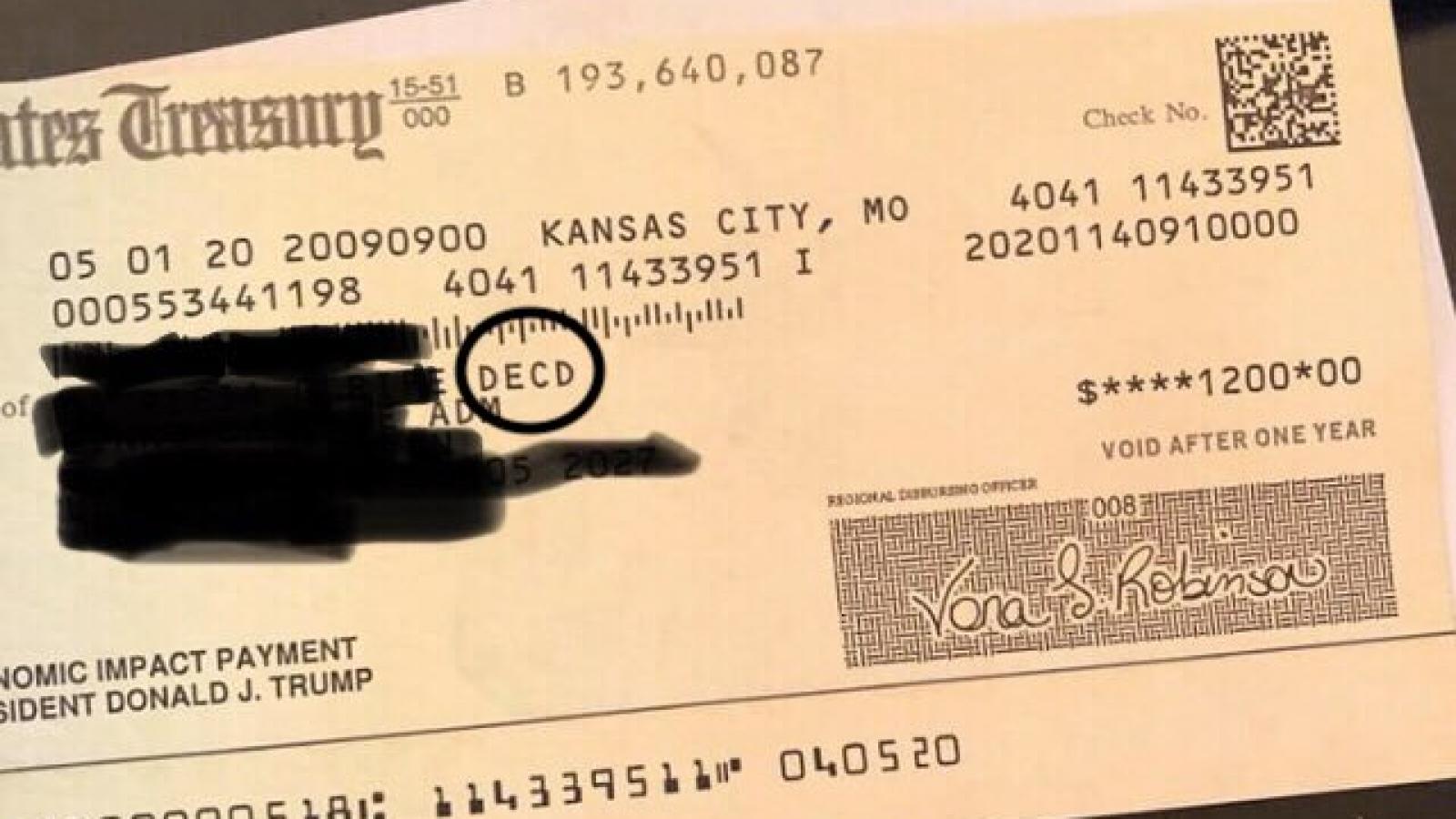

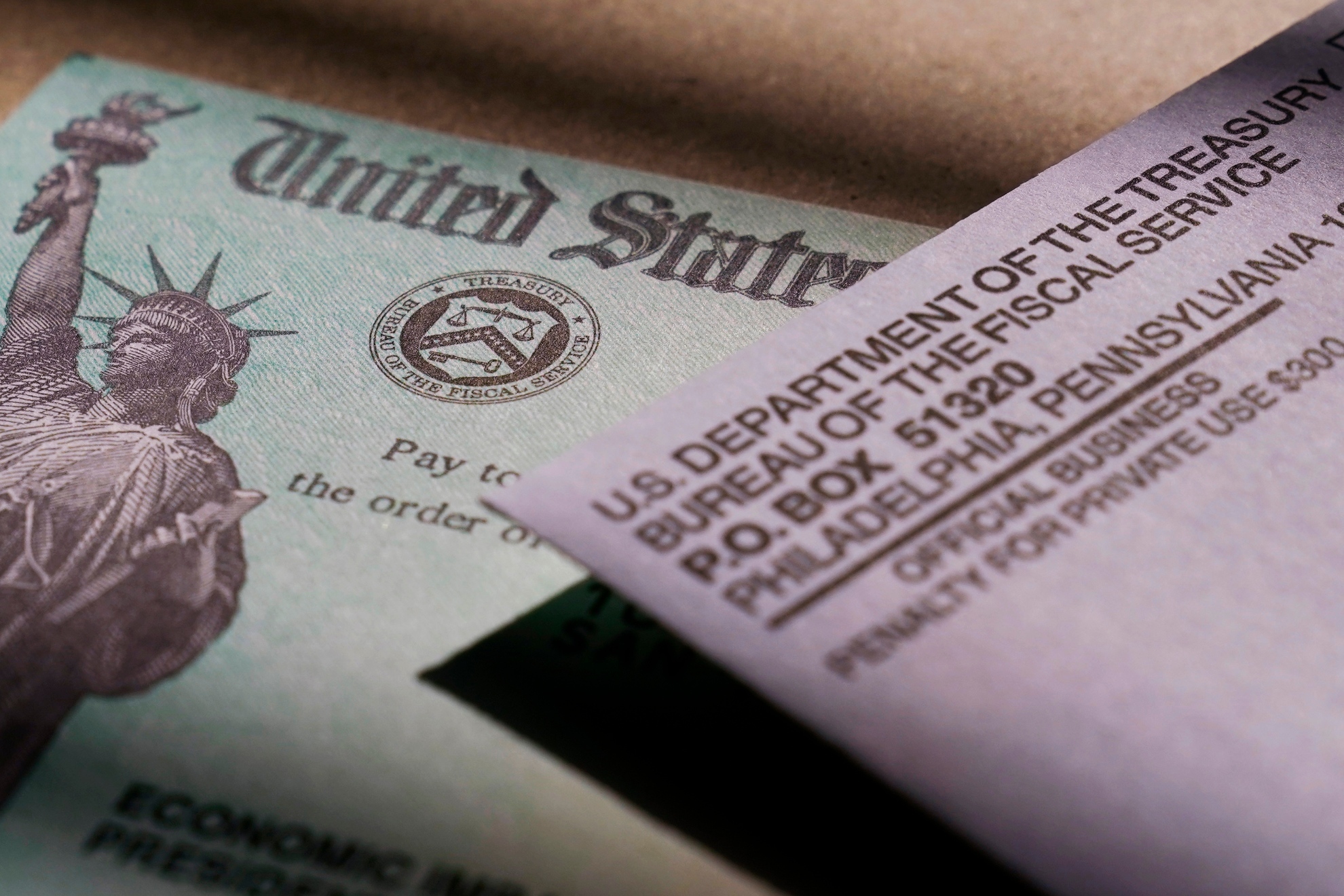

The IRS has already started sending out automatic stimulus payments, and most eligible individuals can expect to receive their payment by

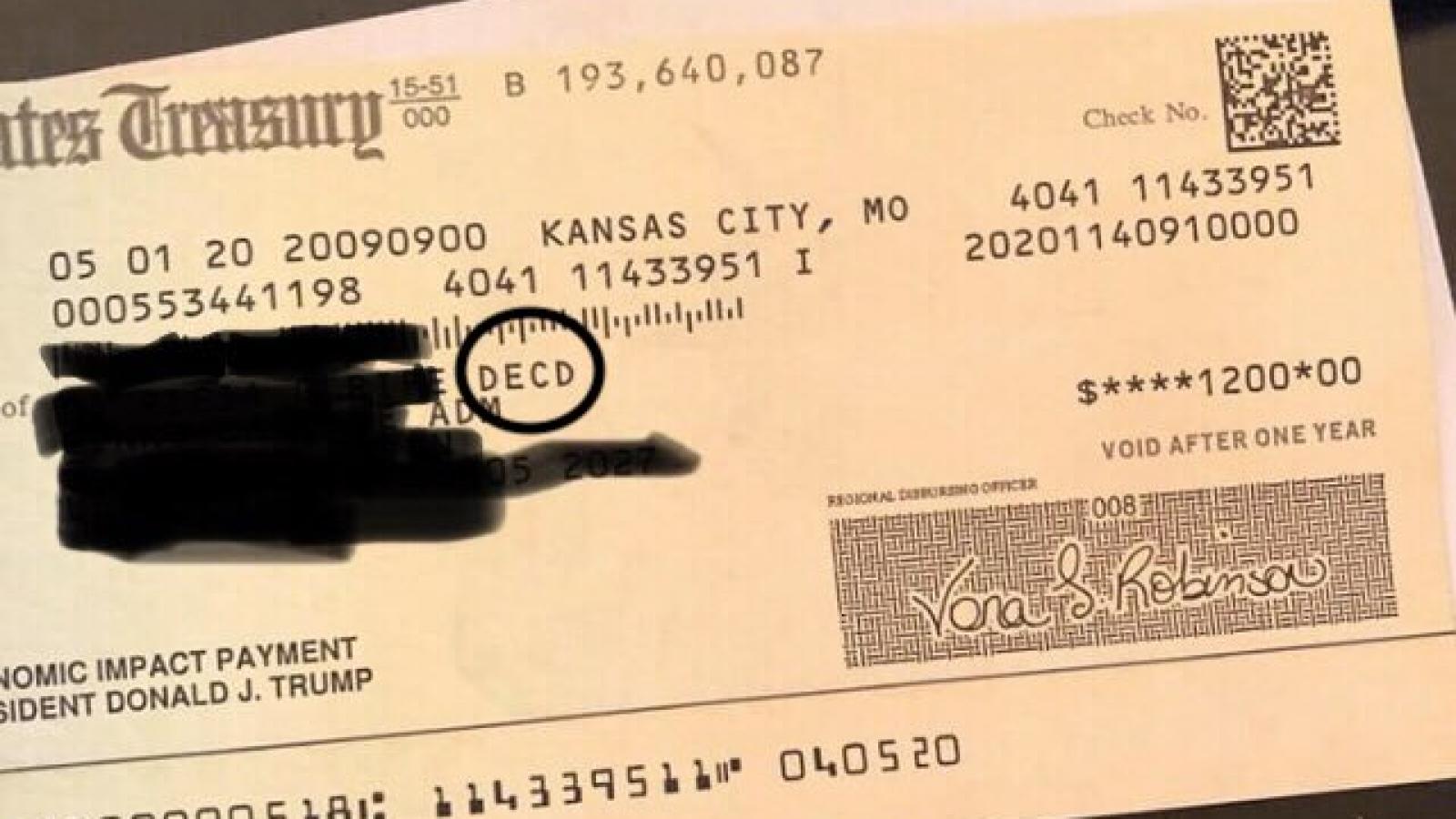

mid-April. Payments are being made via direct deposit, check, or prepaid debit card, depending on the payment method used for previous tax refunds or federal benefits.

What If You Haven't Received Your Payment Yet?

If you're eligible for an automatic stimulus payment but haven't received it yet, don't worry. The IRS is working to distribute payments as quickly as possible. You can check the status of your payment using the

Get My Payment tool on the IRS website. This tool allows you to track the status of your payment, confirm your payment type, and provide or update your bank account information.

The IRS's automatic stimulus payments are a welcome relief for many individuals and families affected by the pandemic. If you're eligible, you can expect to receive your payment automatically, without needing to take any further action. Remember to check the status of your payment using the Get My Payment tool, and don't hesitate to reach out to the IRS if you have any questions or concerns. Stay informed, and stay safe!

Note: This article is for general information purposes only and is not intended to provide tax or financial advice. For specific guidance, please consult the

IRS website or a qualified tax professional.