Table of Contents

- Korelasi Indeks Keyakinan Konsumen (IKK) terhadap Pendapatan Usaha ...

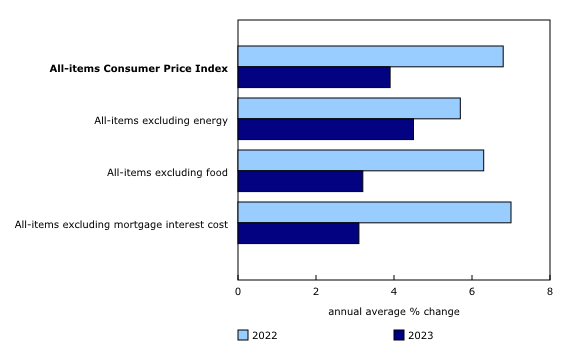

- The Daily — Consumer Price Index: Annual review, 2023

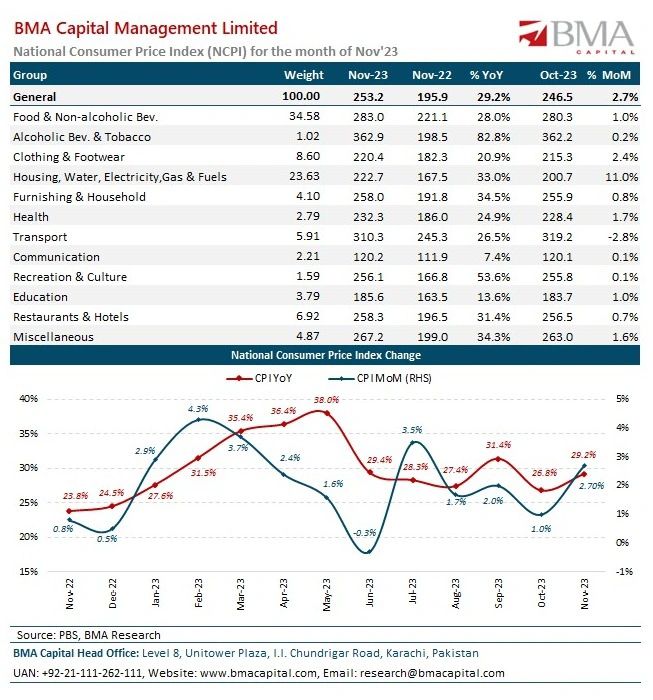

- Abdul Wahid Raja on LinkedIn: National Consumer Price Index (Nov-2023)

- consumer price index

- Consumer Price Index / consumer-price-index.pdf / PDF4PRO

- Consumer Price Index (CPI) of Indonesia; Back to Mild Deflation in ...

- Consumer Price Index

- Indonesia Consumer Price Index | Download Scientific Diagram

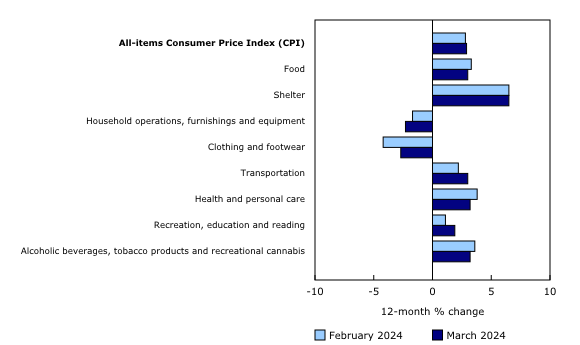

- The Daily — Consumer Price Index, March 2024

- Session | PDF | Consumer Price Index | Inflation

According to recent PDF forecasters' reports, the economic landscape is expected to witness a steady year-over-year Consumer Price Index (CPI) inflation, coupled with an increase in interest rates. This projection has significant implications for investors, consumers, and policymakers alike. In this article, we will delve into the details of these forecasts, exploring the underlying factors driving these trends and what they mean for the economy.

Steady CPI Inflation: A Balanced Economic Growth Indicator

The Consumer Price Index (CPI) is a crucial metric used to measure inflation, reflecting the average change in prices of a basket of goods and services consumed by households. A steady year-over-year CPI inflation rate suggests a balanced economic growth, where demand and supply are relatively in equilibrium. PDF forecasters project that this stability in CPI inflation will continue, indicating a controlled and sustainable economic expansion.

This steady inflation rate is attributed to various factors, including a stable labor market, moderate wage growth, and a balanced monetary policy. The Federal Reserve, in its efforts to maintain economic stability, has been closely monitoring inflation rates, making adjustments to interest rates as necessary to keep the economy on a growth trajectory without overheating.

Rising Interest Rates: A Response to Economic Growth

Interest rates are expected to rise in response to the sustained economic growth and to prevent the economy from overheating. Higher interest rates can help curb inflation by reducing borrowing and spending, thus controlling demand and keeping prices in check. PDF forecasters anticipate that these rate hikes will be gradual, allowing the economy to adjust without significant disruption.

The increase in interest rates also has implications for investors and consumers. For investors, higher interest rates can lead to better returns on fixed-income investments, such as bonds. However, for consumers, especially those with variable-rate debts like credit cards and mortgages, rising interest rates can mean higher borrowing costs, potentially affecting consumption patterns and overall economic activity.

Implications and Future Outlook

The projected steady CPI inflation and rising interest rates suggest a managed economic growth trajectory. While these forecasts are based on current trends and available data, the economic landscape is inherently subject to uncertainties and potential shocks, both domestic and international.

Policymakers, investors, and consumers must remain vigilant, adapting strategies in response to economic indicators and forecasts. Diversifying investments, managing debt wisely, and keeping abreast of economic news can help navigate the anticipated changes in the economic environment.

In conclusion, the PDF forecasters' projections of steady year-over-year CPI inflation and increasing interest rates paint a picture of a carefully managed economic growth. As the economy continues on this path, it's essential for all stakeholders to be informed and prepared for the potential implications of these trends, ensuring resilience and prosperity in the face of economic fluctuations.

For more detailed insights and to stay updated on the latest economic forecasts, downloading the latest PDF reports from reputable financial institutions and research bodies is recommended. These resources provide in-depth analysis and projections, helping individuals and organizations make informed decisions in an ever-changing economic landscape.